An estimated two million new homebuyers could enter the homebuying market with new long-term fixed-rate mortgages with only 5% deposit, said Boris Johnson, when speaking on 5 October as part of the Build Back Better campaign.

These currently do not exist in the UK, a 10-year fixed-rate deal is the longest available and lenders mostly consist of the high street banks offering interest rates at just over 3% for a maximum of 85% LTV.

Lenders have yet to comment publicly and incentives from the government for them to sell these types of mortgages is unknown at this point, it’s likely we’ll see a reversal of legislation brought in after the 2008 crash which required lenders to stress-test applicants.

But with that number of potential new homebuyers to the market it’s sure to stir some lenders interest and we may see some innovative mortgages coming to the market soon. It’s also welcome news for investors and housebuilders in particular, as the demand could push prices higher as well as open the pool of buyers to those who have a 5% deposit but not wanting to use, or completely unfamiliar with, the Help to Buy scheme, that already only requires a 5% deposit.

2020: What’s happened to mortgages for homebuyers?

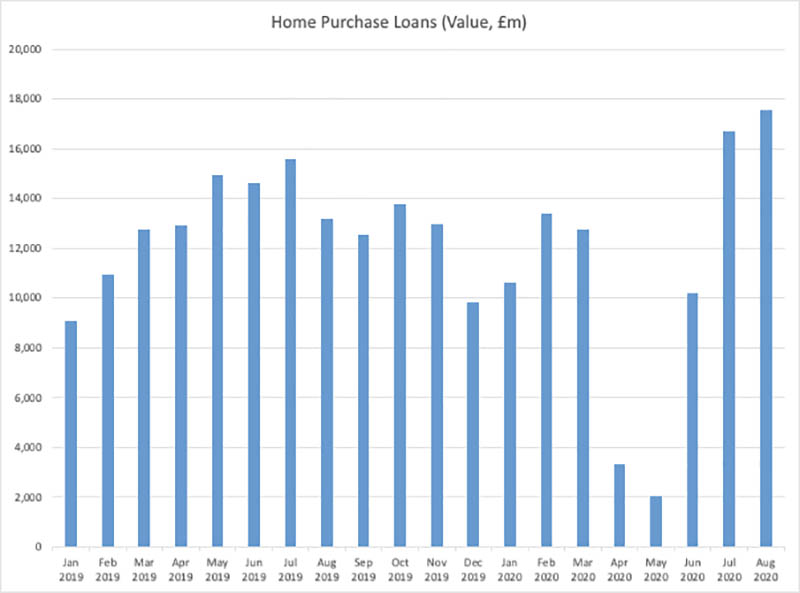

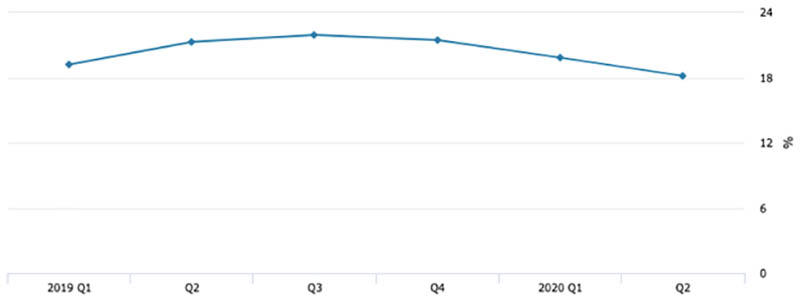

As expected, when COVID-19 hit and the country was at a standstill, mortgage approvals dropped to the floor. But perhaps rather unexpectedly, the rebound was almost instantaneous with July and August (Q3) actually exceeding their respective months last year. The quarter as a whole (Q2) however, was down 33.3% on the same period last year (according to the Bank of England). We’re awaiting final Q3 data, but it’s looking very positive.

Building Societies Association

Building Societies Association

Which LTVs have been affected?

Surprisingly the share of mortgages offered at over 95% LTV mortgages has actually remained unchanged this year, although the volume was already relatively low, it’s been stable at 0.28% of the whole market across 2020, and exactly the same as Q2 2019.

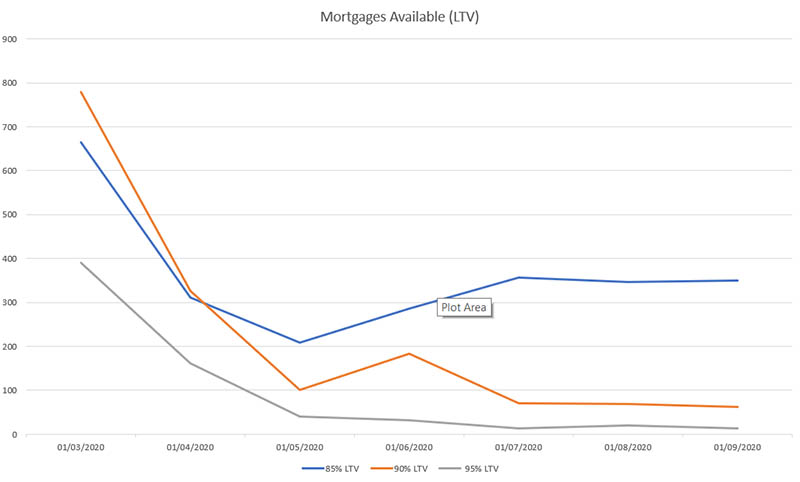

Most lenders have been pulling their 90% LTV products, but not all. Moneyfacts data shows 779 deals were available at the start of March and only 62 in September. HSBC were one of the only big banks still lending at 90% until very recently – they have now introduced a temporary pause citing too much demand. (As they’re riskier, they have longer underwriting processes). We also found demand for new build mortgages at record levels during the summer.

85% LTV products on offer have dropped too, but not to the same extent, with 349 still available, down from a high of 664 in March.

Moneyfacts

Moneyfacts

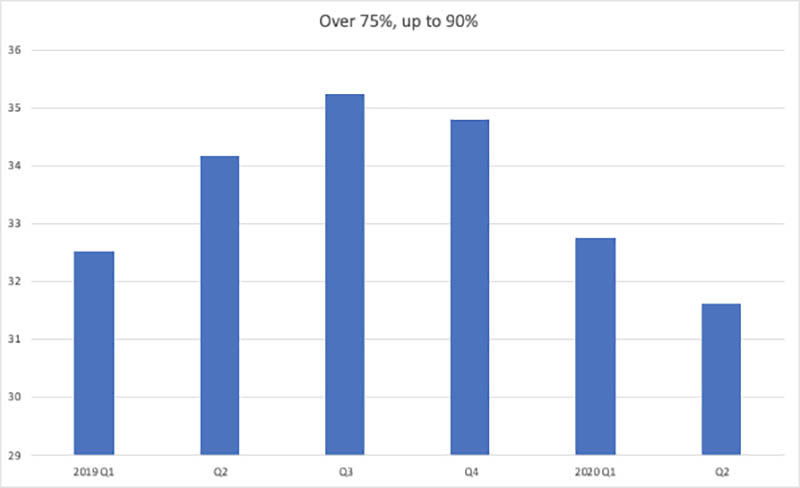

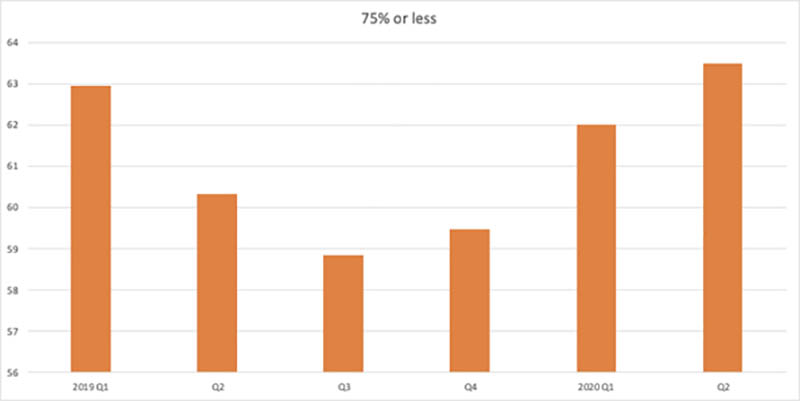

The withdrawal of higher LTVs impact on the homebuying market is fairly significant, with a drop of 7.7% in the share of the market of loans over 75%, up to 90% LTV, vs same period last year. And an increase in share of loans under 75% LTV by 5.1%.

Bank of England

Bank of England

Bank of England

Bank of England

Forcing first-time buyers out of the market?

Lower LTV lending looks to be forcing first time buyers out of the market for now, with the share of market falling 15.8% against Q2 2019.

Higher deposits required?

It’s unlikely then, if you’ve got a small deposit, you’ll be able to buy a new home anytime soon. It could be a great time to save and push on to 15% or higher deposit. Or perhaps a government scheme could help? Lenders with mortgages for buying with Help to Buy equity loans, so LTVs typically at 55% and 75% are very much open for business.

Has the borrowing amount been affected?

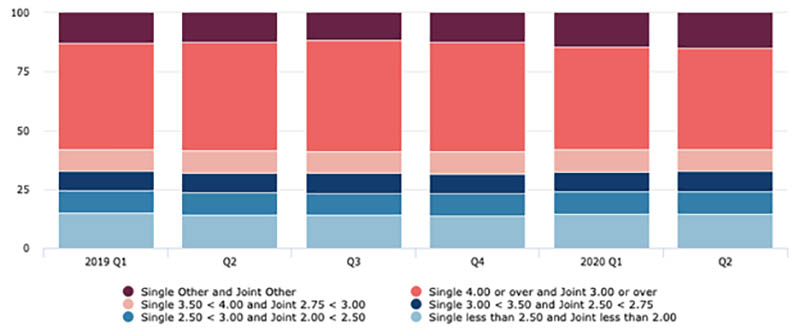

Good news for borrowers, loan-to-income (LTI) ratios remain relatively unchanged, with high loan-to-incomes only falling 0.6% to 43.1% from Q1 to Q2. Suggesting lenders are still happy with individual borrowing amounts. High LTI is single income 4x or high and joint income 3x or higher.

Bank of England

Bank of England

Investors taking advantage?

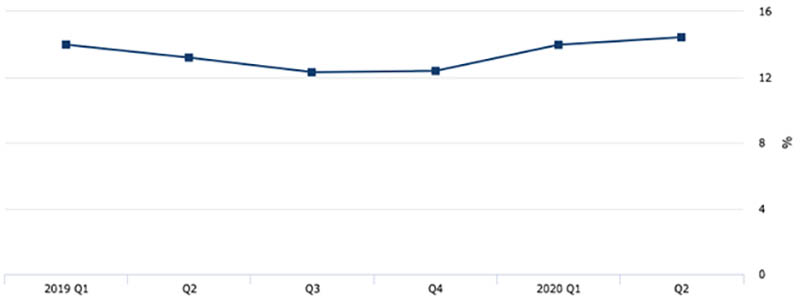

The share of buy-to-let borrowing has actually increased during Q2 of this year, up 1.2% on the same period last year. Although this does include remortgaging, where in the residential market, the share of the market is up 24.4% on last year (Q2).

Bank of England

Bank of England

Summary: what’s changed for those buying new builds?

Overall, not too much change. Lenders have been mostly concerned with the risk of lending against possible falling house prices, alongside staffing capacity to actually underwrite higher LTV mortgages, rather than anything more specific to new builds. When they solve this problem, we could see an incredible recovery going into 2021.

This means for now, lenders have focused on and made adjustments to the loan-to-value they are willing to lend at, but everything else remains relatively unchanged. You can borrow the same amount as before, and use Help to Buy. Although you may find difficulty with Shared Ownership, which typically see higher LTVs.

And with Boris’ announcement, the future is looking very promising for both those looking to get onto the property ladder and housebuilders themselves.