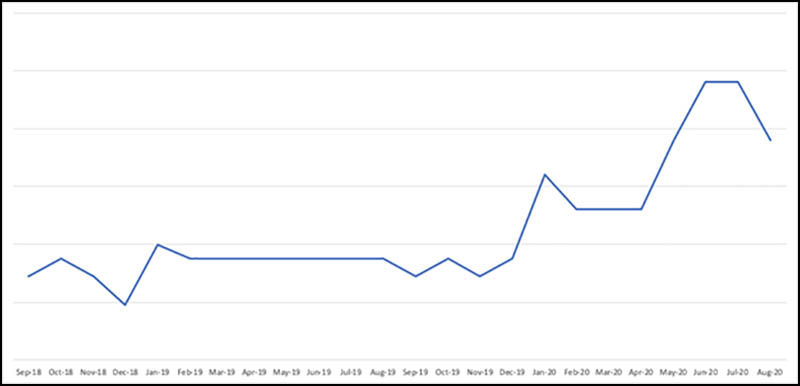

Mortgages are having quite a ride during 2020. With demand dropping to yearly lows in March all the way to spectacular all-time highs during the summer, and especially for new builds, with a staggering increase of 164% in searches on the year before.

Here’s a review of the market and your options for getting a mortgage for your new build home, it might just be the perfect time.

Searches for new build mortgages in the last 24 months

Google search data

Google search data

First of all, what do mortgage lenders count as a new build?

The definition of a new build actually changes across mortgage lenders. The typical definition however is “property that has been built, converted or refurbished within the last two years”, and includes properties being bought off-plan and properties that may have tenants in but still currently owned by the developer.

A quick overview of how mortgage lenders view new builds

Mortgage lenders lend on risk, it’s almost a pure mathematical decision, and similar to brand new cars, the value of new build homes tend to fall slightly after purchase, but unlike cars, they don’t keep falling and tend to retain their value or increase in the years after.

What that means for mortgage lenders and new builds is they don’t like being too exposed to this initial risk and holding assets that might have a lower value than the amount lent. So they tend not to lend at a high loan-to-value (LTV) – that’s loans with LTVs of 95% and 90% – the equivalent of you putting up as little as 5% or 10% deposit.

What they do like however, is sharing that risk with the government. And that’s where Help to Buy and Shared Ownership comes in, where you can buy homes with as little as 5% deposit.

Your mortgage options for new builds

If you’ve already found a property you like, you probably know which purchase option you need to go for, if you haven’t found a property yet, you’ve got three options for buying a new build property:

- Standard mortgage

- Help to Buy Equity Loan

- Shared Ownership

You can use a standard mortgage on almost any new build, but you can only use Help to Buy or Shared Ownership on properties specific to these schemes, and the developer will market them as such. It’s best to pick a scheme that you think works for you, and then go searching for properties specific to those schemes.

Here’s a great guide on mortgages in general, if you’re not too familiar.

Standard mortgages: your options

Are you lucky enough to have a large deposit?

If you have a large deposit, the world's your oyster when it comes to new builds and all homes for that matter, and you’ll get to own the property outright if you opt for a standard mortgage. For new builds expect to be able to borrow around 85% for a house and 75% for a flat, you may find some lenders going up to 85% for a flat, but your options are very limited.

Since the COVID-19 outbreak began 95% mortgages have completely gone and you will be incredibly lucky to find mortgages at 90% currently for new builds (it was hard before), and in fact any property. As it stands, towards the end of 2020, there is currently only one 90% mortgage on the market, from Nationwide, and it’s not for new builds.

Something to consider, you could use your deposit alongside a government scheme, such as Help to Buy, which is interest free for five years, to reduce the amount you need to borrow fairly significantly, and therefore reduce your LTV (loan-to-value) to get a lower interest rate on a mortgage and lower monthly repayments.

Another option, depending on how much you can borrow, is to leverage the schemes to purchase a bigger or better located and more expensive property. To get a realistic figure of how much you can borrow, you can get a mortgage-in-principle online.

Wait, lenders see flats and houses as different?

Mortgages lenders view lending on new build houses as less riskier than new build flats, and so further limit the loan-to-value (LTV) on flats, which for most lenders is capped at 75%, whereas with a house they are very happy to lend at 80%, and 85% too, but will lower the amount you can borrow to lower their overall risk. Nationwide for example, have maximum loans of £1,000,000 for 80% and £750,000 for 85%.

Also you need to know this if you’re looking to buy in a block of flats, recently in December 2019, mortgage lenders introduced another step to reduce their risk, and that’s a review of the external wall system; that’s the cladding, insulation and fire break systems.

The review needs to be carried out by a qualified professional, who will give the whole building a signed EWS1 form valid for five years.

The review needs to be carried out by a qualified professional, who will give the whole building a signed EWS1 form valid for five years.

The process is managed by the building owner, and if it’s a brand new block they should have this, but the lender will require the form before they can issue a mortgage offer, or if construction work started after 2018, proof that the building complies with updated 2018 building regulations.

Do you have a more modest deposit? If like most people you have a more modest deposit, your best options are the government schemes; Help to Buy Equity Loan and the Shared Ownership scheme in association with a Housing Authority.

Help to Buy Equity Loan: your mortgage options

I’m sure you’re familiar with the Help to Buy scheme, but a quick recap, the government will provide you with support to purchase a new build home, in cash, 20% outside of London and 40% inside London, as long as you can provide at least 5% yourself.

What this means for mortgages – this support counts towards your deposit! So, let’s say you are buying a home outside of London and using the maximum support allowed, your new deposit is 25%. That means you only need a mortgage for 75%. And if you’re buying in London, that drops to 55%.

These lower LTV bands open up the range of mortgages available and lower interest rates, as lenders are taking on less risk.

But wait, you can’t just apply for any standard mortgage. You’ll need to look for a mortgage specific to Help to Buy. You don’t need to do this yourself of course, a mortgage broker will do it for you, but make sure you tell them you are planning to use Help to Buy.

They are mostly the same as standard mortgages, but the range available is lower, you’ll typically only find them from high street banks and building societies, and some lenders will add on a slight premium. For example, Barclays have a two-year fixed rate mortgage product at 75% LTV with an interest rate of 1.70%, but with Help to Buy, it’s 1.84%.

COVID-19 has had little impact on Help to Buy mortgages, the range and availability hasn’t dropped and there’s still around 30-40 lenders at any one time with mortgages available. What has been impacted however, is the time it takes for a lender to process an offer and the Help to Buy scheme itself, which is seeing a huge increase in demand, and has extended their timeframe to process documents. An authority to proceed, for instance, is now 25 working days.

If you’re not a first-time buyer, your time is running out to use the Help to Buy scheme. The current scheme is ending in March 2021 and a new scheme will start as of April 2021 just for first-time buyers. Learn more here.

Shared Ownership: your mortgage options

Shared Ownership is almost exactly the same as a standard mortgage as you are borrowing a set amount to pay for your share of the property. There’s no additional deposit provided from the government like there is with the equity loan, which means you need to borrow at higher LTVs and higher interest rates. But do let your mortgage broker know you are buying through Shared Ownership as you’ll need to apply for the specific range from the lender.

Typically, 90% LTV was very common for Shared Ownership and even 95%, as you’re getting a mortgage on your share, not the whole property.

In 2020, post COVID-19, it’s looking near impossible. The highest you can get is 85%. So you may need to consider dropping down the share you are buying to increase your deposit. But the good news is the range of lenders is large, there’s over 50 mortgage products currently available at 85% LTV for Shared Ownership.

Whichever route you decide to buy with, here’s what to consider when looking for a mortgage

- The loan-to-value (LTV): It’s not easy for first time buyers and raising a deposit, but the lower LTV you can get, that’s having a higher deposit, the lower the interest rate and the cheaper your mortgage will be.

- Watch out for the interest rate: Don’t default to thinking the lowest interest rate is the cheapest mortgage. There are lender fees to include and sometimes other hidden charges. Lenders often ‘game the system’ with low interest rates and offset these with high fees. On a positive note though there’s sometimes also incentives from lenders, such as cashback, which need to be factored in.

- Mortgage fees: The lender will typically charge you for taking out the mortgage, called an arrangement fee, and this can be fairly big, sometimes £1,000s, however normally £100s and sometimes zero. Factor this in too. You can normally add these onto the mortgage amount, but you’ll then be paying interest on this too.

- Overall cost of the mortgage: Combining the interest rate and the mortgage fees, and a little bit of maths and you’ll get the overall cost of the mortgage during the fixed term period. This is what you use to compare mortgages as it’s what you’ll actually be paying out. Use a mortgage broker and they’ll do all this for you and just let you know the best one for you.

- The mortgage term: This is the total length of the mortgage in years. If you want lower monthly payments you can opt for a longer mortgage term, but it will cost you in interest, and by quite a bit. You can go up to 35 years on a new build, and it’s fairly common. But if you can afford it, paying higher monthly payments on a shorter mortgage term will save you £1000s in the long run.

- How long to fix your deal for: With a typical mortgage there’s an introductory period where the rate is fixed for normally either two or five years at a lower rate (to help sell the mortgage), and then you’ll switch to the lenders standard variable rate (SVR), which is higher, normally double. At this point you would remortgage to a better deal with a new lower fixed rate. It’s up to you how long you want to fix the mortgage for, two-year fixes have more flexibility, but five-year fixes have the stability and certainty of consistent monthly payments. If you took on a two-year fixed, you could remortgage and borrow more twice in six years, and staircase up on your Shared Ownership or Help to Buy Equity Loan with the view to owning the property outright by then. Or, if you wanted to sell and move on, time the sale so you fall onto the SVR where you wouldn’t be penalised with early repayment charges (ERCs). But with a five-year fixed, you could just relax and let the mortgage tick by until it’s time to pay interest on your Equity Loan, at which point you could remortgage to pay it off (if affordable), or sell up after five years and move on without ever paying the interest. If you sell before this however, or try to staircase up, you could be liable for early repayment charges.

- Early Repayment Charge (ERC): During the introductory period of your mortgage, where the rate is lower, your mortgage will have early repayment charges in the contract, these are simply charges if you want to pay off your mortgage during this time, which is normally through selling the property. These are fairly big fees, but step down over the length of the fixed-term period. So for a five-year fixed deal, it may start at 5% of the mortgage and step down 1% each year, so 5%,4%,3%,2% down to 1% in the final year. And on a teo-year fixed term deal it may start at 2% and then 1% in the final year. These do changes across lenders, so it’s worth checking.

It’s potentially never been a better time to get a mortgage

With all the above in mind, which is quite a lot to consider! And the overall mortgage market, the conditions are looking very favourable for those looking to buy and remortgage.

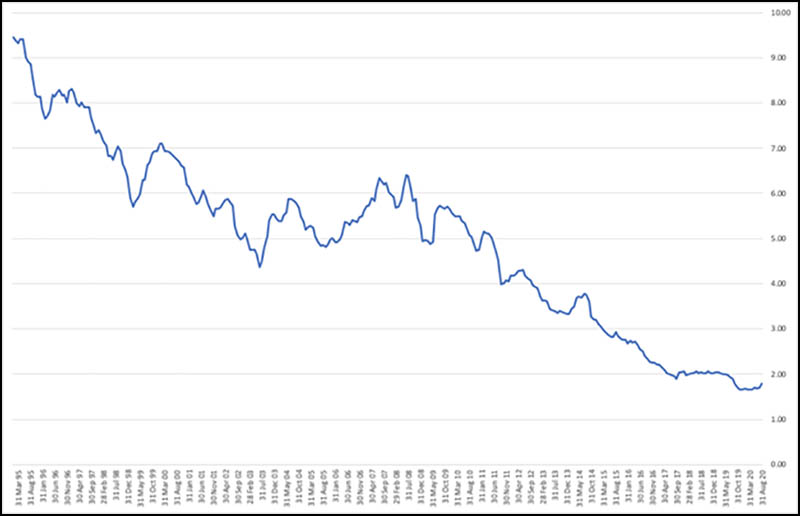

With the Bank of England base rate held at 0.5% for many years and now since COVID-19 at 0.1%, it’s impact on the mortgage market has been quite strong.

In fact mortgage rates are at the lowest they’ve ever been in recorded history, with the average 5 year fixed rate deal of a 75% LTV mortgage at 1.70% (July, 2020).

Mortgage interest rates over time (75% LTV, 5 year)

Bank of England, 2020

Bank of England, 2020

And with the Stamp Duty holiday for all buyers until 31 March 2021, you may find it’s the perfect time to find your dream home.