Moving home? Watch out for unexpected costs

The majority of people who have bought a property in the past five years faced unexpected costs that meant they exceeded their original moving budget, new research from London removals firm Kiwi Movers has found.

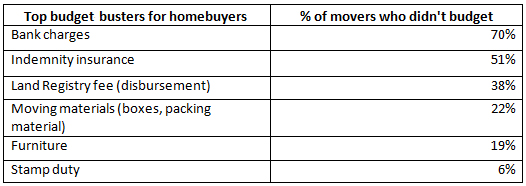

The most common source of unexpected expenditure were bank charges for money transfers, with 65% reporting that they did not budget for these. Insurance add-ons were another common expense that movers didn’t expect. More than half (51%) said they paid for indemnity insurance and went over budget as a result.

17% of those who went over budget said they had to borrow, either on a credit card, overdraft, loan or from friends or family to meet unexpected house move costs. Of those who had to borrow, 34% had to borrow more than £300. A small amount (8%) borrowed more than £500.

The biggest unexpected costs were...

More moving costs to come

Forthcoming changes to how banks process large payments could lead to further costs for movers, potentially of up to £28m a year.

The cut-off time for payments made using the Clearing House Automated Payment System (CHAPS) is being moved back an hour and forty minutes this summer. This could potentially delay the handover of the keys by almost two hours as banks leave it later to send payments. The present system requires banks to move the money from their account by approximately 3pm to allow for it to reach the solicitor’s account before close of business.

The knock-on effect of this change is that movers will be waiting until later in the day to collect their keys, resulting in increased removals costs, especially if they’re hiring their removals team by the hour. This could mean house movers pay more than £100 extra to move house.

Regan McMillan, director of Kiwi Movers explains how the changes could impact people moving house this year: “Customers can’t get the keys to the property until the money transfer is complete, so if there’s a delay at the bank end, it has a knock-on effect with removals, storage and deliveries.

“The one upside of the current system is that we usually know by 4pm whether a transfer will go through on a given day, giving us enough time to get things into storage if necessary. With the time being pushed back, removals firms could be waiting on keys for a further two hours and still to be told they’ll need to come back tomorrow. It could get quite chaotic and expensive for a lot of house buyers.”

More on the cost of furnishing a home here...