For those of us living in an instant culture with one-click ordering and same-day delivery, Britain’s antiqued home buying process can make the property ladder look a little rusty. Furthermore, a decisive election result in December has stoked property prices, and it’s easy to be intimidated by the monstrous deposits now required.

But don’t despair. Prop tech companies are increasingly turning their attention to disillusioned First Time Buyers. From bulking up your deposit and bolstering your credit score to turbocharging your mortgage application, the home buying process is being reprogrammed for the digital age.

EASING CREDIT

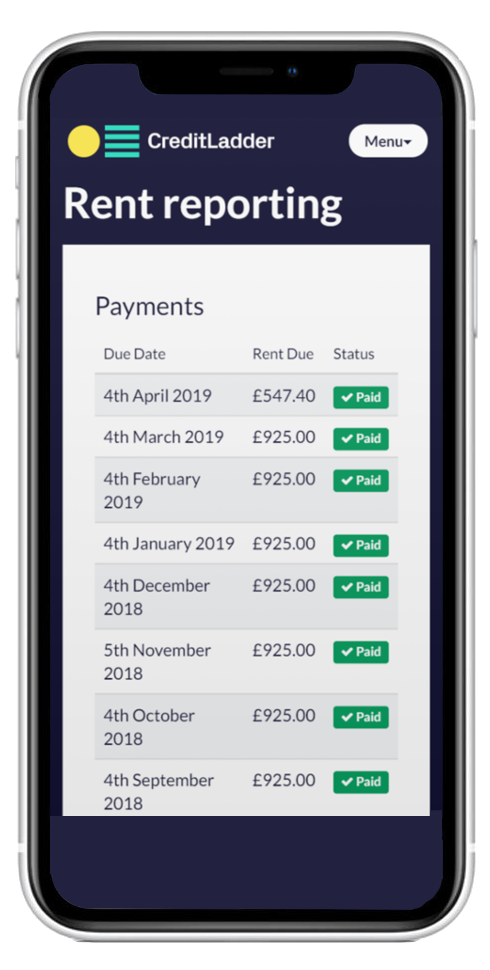

Renting is your biggest monthly expense, and yet lenders can’t take it into account when working up a credit score. That this is grossly unfair has not escaped the attention of prop tech companies.

In 2018, three tech companies – Bud, CreditLadder and RentalStep – won government funding to try and right this wrong. While all three have different methods, from AI to OpenBanking technology, their mission is the same – to get your monthly rent payments added to your credit history.

Following a five-minute signup process, your rent will be taken into account when banks conduct mortgage affordability assessments. This lowers the first rung of the housing ladder by giving you the same access to affordable finance as those who’ve owned their home for years. As long as you pay your rent on time.

FINDING FINANCE

With the price of starter homes rising three times faster than the wider market, getting on the property ladder means embracing some truly terrifying figures. It isn’t surprising that raising a deposit is often cited as the biggest barrier to homeownership. However, technology is in your corner.

StepLadder has refashioned an age-old financial model for the modern world. The online platform uses something called a rotating savings and credit association (ROSCA) scheme to help buyers save for a home more quickly. There is nothing new about this approach – in fact, it’s been used by cultures all over the world for centuries. It was the genesis of building societies.

The difference now is the latest technology makes it faster and safer than it’s ever been before. It works by matching savers based on how much they want to save every month. Savers are sorted into circles, where everyone contributes the same amount of money. At the end of the month, a random draw dictates which member gets the whole pot to put towards a deposit. It can help you save a deposit in half the time – unless you’re the unlucky soul who is drawn last.

There are various safeguards in place to make sure the system isn’t abused, and while StepLadder charges a fee, it isn’t for profit. Its community app gives members access to group-buying discounts on services such as mortgages, solicitor fees and surveyors, which is where it makes its money.

MAKING MORTGAGES EASY

In October 2019, Proportunity came on the scene with a new model that uses artificial intelligence (AI) to crunch data and offer home equity loans to First Time Buyers.

The London-based fintech company has styled itself as the only challenger to Help to Buy, the government scheme facing demolition in 2023. “Homeownership figures are in freefall,” said the company’s founder and CEO, Vadim Toader. “Proportunity is a tech-driven mortgage lender that helps first-time buyers get on the property ladder by removing their biggest barrier to homeownership – large down payments.”

AI-powered mortgages can also help you put your precious cash in the right place. “The extra edge really comes from our machine learning-powered real-estate analytics engine that helps buyers cherry pick property gems, i.e. homes worth 20-30% more than their asking price, from the thousands of new listings skimmed through every day,” said Toader.

Proportunity is far from the only proptech company trying to reboot the mortgage market. Coadjute is developing new mortgage technology with a consortium of property software providers and banks, including NatWest. Ultimately, the goal is to complete the entire homebuying process via an app.

“Getting a mortgage and moving home is a slow, complex and confusing process with buyers having to knit together services from multiple businesses,” said John Reynolds, CEO and Founder of Coadjute. “This is a particularly daunting task for First Time Buyers who, by definition, have had limited exposure to the processes involved – the challenges of which can sometimes dissuade the uninitiated from even starting the home buying journey.”

INSTANT RESULTS

If you find the mortgage market confusing, you’re far from alone. A recent study by Santander laid bare just how bewildering buying your first home can be, with 62% of First Time Buyers believing that ‘exchange’ referred to swapping keys on moving day.

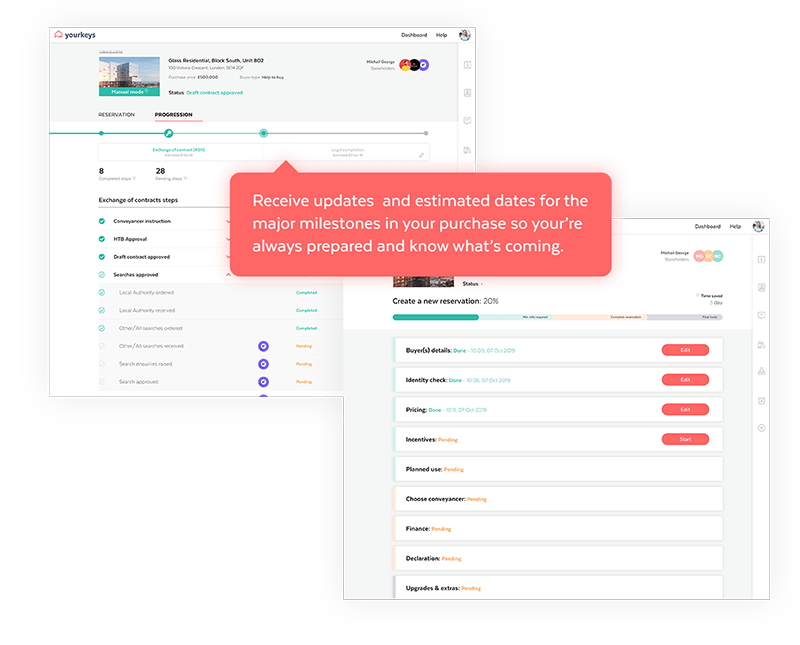

Blockchain, the digital scaffolding behind crypto currency Bitcoin, can cut costs and confusion by soldering the many strands of the housing market together. In January, instant property purchases came a click closer, as Yourkeys completed the first fully digitised property transaction in just 11 days, compared to the industry average of 63 days.

Yourkeys CEO, Riccardo Iannucci-Dawson, said: “The problem is that there are lots of companies involved in each transaction and their systems don’t talk to each other. We saw the opportunity to build a data layer that pulls together inputs from everyone involved in the process.”

No mean feat, when you consider that there are thousands of legal firms and financial advisors nationally. “This was a huge challenge but working with our partners, we achieved it and now have over 2,500 companies directly integrated into the platform,” Iannucci-Dawson added.

Britain’s creaky home-buying process may seem otherworldly for property newbies; however, with the right technical support, home may be closer than you think.