UK house prices soar 1751% since last European referendum

The UK housing market has seen a more than eighteen-fold increase (1751%) in average prices since the last time voters were asked whether Britain should stay in or out of Europe, according to research by property crowdfunding platform Property Partner.

Compared to other investments, residential property has outperformed all other asset classes including stocks and shares (increased 9.5 times since 1975) and gold (up by more than 12 times).

Residential property prices in London have risen the most, rocketing by 3200%, almost double the annual UK average house price growth, since the second quarter of 1975 when Prime Minister Harold Wilson put forward a referendum on what was then known as the European Economic Community (EEC).

Today, a little more than four decades on and just over two months from the UK’s second ever European referendum which takes place on 23 June 2016, the average UK house price is now £198,564. Back in June 1975, house hunters were being asked to fork out on average £10,728. Today, in real terms, taking into account inflation, that would have been just £99,949.

Property Partner analysed quarterly house price figures dating back to just before the Common Market referendum in June 1975. Out of 164 quarters since Q2 1975, only 30 (18.3%) have seen negative house price growth. From Q2 1990 to Q3 1993, there were 14 consecutive quarters of negative growth, the longest stretch in the past 40 years.

Just before the last European referendum, quarterly price growth had slowed dramatically to 7%, a year after hitting 18.2%, and two and half years after recording the highest ever quarterly average house price rise of 42%. Average quarterly price growth didn’t fall as low as 7% again until Q4 1980, more than five years on from the referendum.

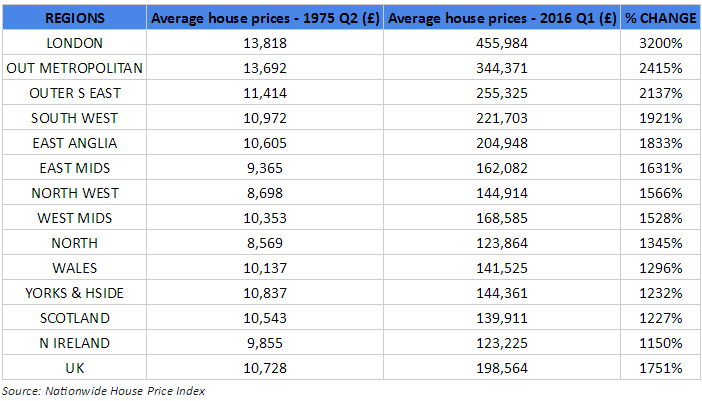

The table below shows a snapshot of the UK and regional average annual house prices in Q2 1975 (April-June) compared to Q1 2016 (Jan-March), just three months before the EU referendum.

Dan Gandesha, CEO of property crowdfunding platform Property Partner, says: “With all the nervousness and uncertainty around whether Britain is going to stay in or out, our research shows that although average house prices softened in the run up to the last referendum in 1975, they have risen a staggering eighteen-fold since, leaving all other asset classes in the shade.

“There is never any guarantee that prices will continue to rise, but even taking into account factors which may put a brake on growth, such as the recent 3% stamp duty hike on second homes and buy-to-lets, if the past is any indication, property will remain a strong long-term investment.

“London in particular has been consistently the star performer, although the capital has been transformed in the past four decades attracting huge inward investment. Whatever the result on June 23, London will remain a truly global city.”