Nationwide’s Figures Report House Price Rebound

The latest data from Nationwide Building Society shows that national house prices are continuing to grow year-on-year and month-on-month.

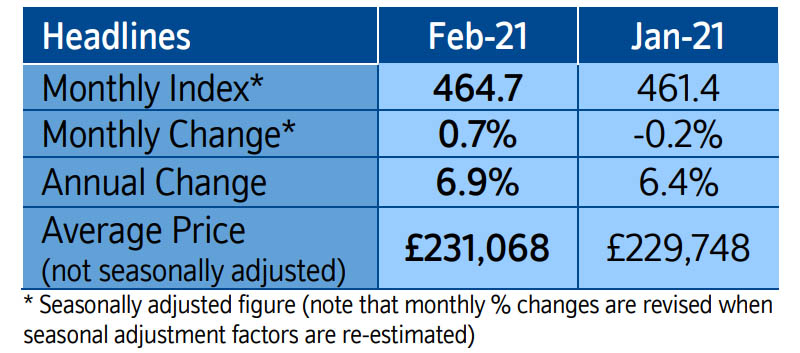

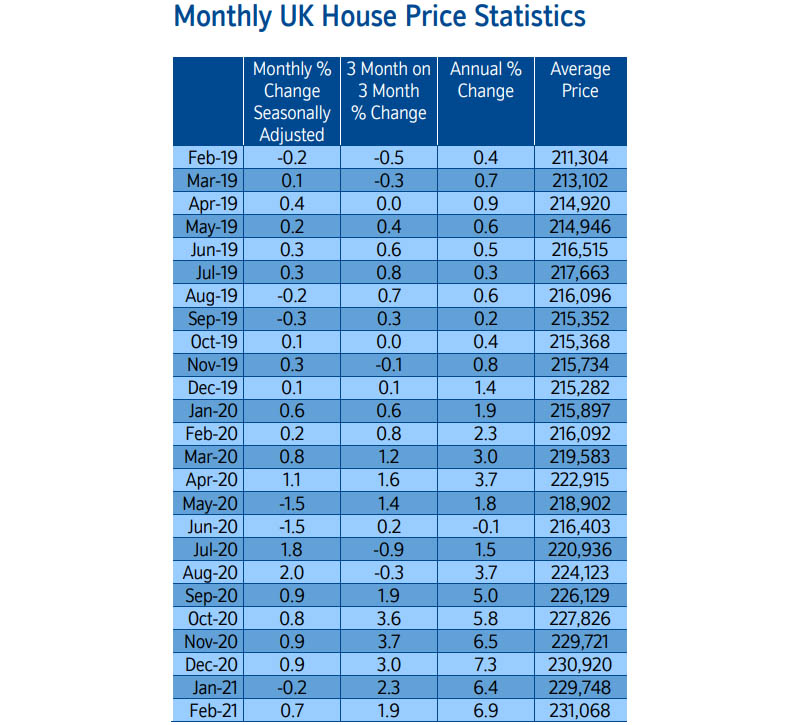

The headline numbers show annual house price growth rebounded to 6.9% in February from 6.4% in January. Prices up 0.3% month-on-month, more than erasing the small decline seen in January. The resulting average price of £231,061 is the highest on record

Commenting on the figures, Robert Gardner, Nationwide's chief economist, said: “February saw the annual rate of house price growth rebound to 6.9%, from 6.4% in January. House prices rose by 0.7% month-on-month, after taking account of seasonal effects, more than reversing the 0.2% monthly decline recorded in January.

Commenting on the figures, Robert Gardner, Nationwide's chief economist, said: “February saw the annual rate of house price growth rebound to 6.9%, from 6.4% in January. House prices rose by 0.7% month-on-month, after taking account of seasonal effects, more than reversing the 0.2% monthly decline recorded in January.

“This increase is a surprise. It seemed more likely that annual price growth would soften further ahead of the end of the Stamp Duty holiday, which prompted many people considering a house move to bring forward their purchase.

“While the Stamp Duty holiday is not due to expire until the end of March, activity and price growth would be expected to weaken well before that, given that the purchase process typically takes several months (note that our house price index is based on data at the mortgage approval stage).

“It may be that the Stamp Duty holiday is still providing some forward momentum, especially given the paucity of properties on the market at present. Shifts in housing preferences may also be providing a more significant boost to demand, despite the uncertain economic outlook.

“Many peoples’ housing needs have changed as a direct result of the pandemic, with many opting to move to less densely populated locations or property types, despite the sharp economic slowdown and the uncertain outlook.

“As a result, the outlook for the housing market is unusually uncertain. There is scope for shifting housing preferences to continue to boost activity, especially if there is further policy support in the Budget. Nevertheless, if labour market conditions weaken as most analysts expect, it is likely that the housing market will slow in the months ahead.”

Nigel Purves, CEO of finance company Wayhome, said: “The market now waits with baited breath to find out whether the deadline ends up being extended for a further three months or not, and what the long-term impact of either choice will be. As a result of the pandemic, increasingly we are seeing lenders ask potential buyers for a deposit of at least 10% to help alleviate any economic concerns. For many, this tougher requirement can leave them feeling they have no choice but to rent, and that homeownership is unattainable. Going forward, it’s vital that the industry works together to raise awareness of other innovative ways to help get people on the property ladder.”

Nigel Purves, CEO of finance company Wayhome, said: “The market now waits with baited breath to find out whether the deadline ends up being extended for a further three months or not, and what the long-term impact of either choice will be. As a result of the pandemic, increasingly we are seeing lenders ask potential buyers for a deposit of at least 10% to help alleviate any economic concerns. For many, this tougher requirement can leave them feeling they have no choice but to rent, and that homeownership is unattainable. Going forward, it’s vital that the industry works together to raise awareness of other innovative ways to help get people on the property ladder.”

Miles Robinson, head of mortgages at online mortgage broker Trussle, commented: “It’s now expected that Rishi Sunak will extend the tax break by three months in the Budget tomorrow, so buyers may be pushing forward with their purchases to benefit from the tax relief.

“However, our research shows that the economy could benefit from a £28billion injection if the government considered a tapered ending to the Stamp Duty holiday rather than sticking to a hard stop. This would involve guaranteeing the tax break to buyers who received a mortgage offer, for example before 1 February, helping to avoid the collapse of property chains dependent on the savings from the holiday to complete. Extending the deadline by three months will only delay the current cliff-edge deadline that the market faces, and will continue to pose a risk to property transactions later down the line.

“The Budget is tomorrow, and we’re calling on the government to consider taking another look at how to bring the scheme to an end.”