Leading lender predicts best buy-to-let capital gains and yields

Leading short-term property lender Amicus has conducted research among landlords to determine which kind of properties are likely to be the best performers over the next year for buy-to-let property investors.

The professional landlords they spoke to are tipping one-bedroom apartments to produce the most attractive capital returns, with two-bedroom flats likely to generate the biggest yield, says the survey.

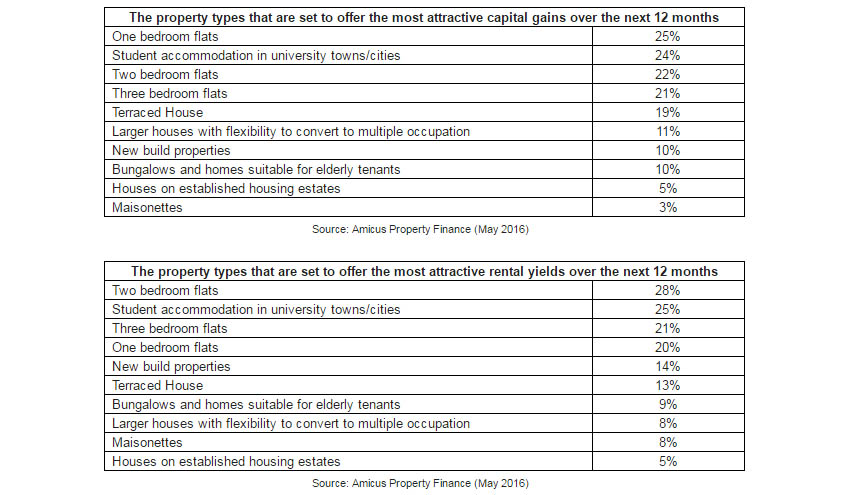

Some 25% of the landlords questioned said that one-bedroom flats will offer the most attractive capital gains over the next 12 months, closely followed by student accommodation in university towns and cities (24%). Maisonettes were the least popular option with only 3% landlords predicting capital gains for this property type.

In terms of the best rental yields, 28% of landlords backed two-bedroom apartments, with student accommodation in university towns and cities once again following closely behind, with 25% backed by those surveyed. In last place are houses on established estates, with just 5% support from the full-time buy-to-let landlords questioned.

The full results are shown in the tables below:

John Jenkins, chief executive of Amicus, says of the research: “The findings show flats are the clear winners over houses and maisonettes for both capital growth and rental yields and this is reflected in our own experience in servicing professional landlords’ short-term borrowing requirements.

“Despite some uncertainty in the consumer buy-to-let sector as a result of changes to stamp duty charges, we’re seeing a sustained and growing appetite for short-term property finance driven by the tightening of mainstream bank underwriting requirements and the inability of some lenders to act sufficiently quickly to respond to demand.”

Amicus has lent more than £800m on property loans since it was formed in 2009, with 85% of its current portfolio comprising residential properties. The firm typically lends between £50,000 and £7m for a project.