135% increase in privately rented homes in past 30 years

The number of private rented sector homes has increased by 135% over the past 30 years, with a 346% increase in the number of households aged between 35 and 44 in this sector, according to new research by Martin & Co, the UK’s largest lettings and property management franchise business.

Martin & Co’s report, ‘30 years in the Private Rented Sector’, has shown that growth has been particularly significant in the past 10 years with a staggering two million new households entering the private rented sector across England alone, and the number of private rented properties overtaking the social housing sector in 2012. 71% of households aged between 16 and 24 now live in a privately rented home, up from 32% in 1986.

The introduction of buy-to-let mortgages in the mid 90s is also a significant factor. They now account for 18% of the mortgage market with £338bn worth of mortgage loans on buy-to-let properties advanced since the late 1990s, according to the research.

Michael Stoop, managing director of Martin & Co says: “Given the increase in larger families renting homes, we predict investors will diversify their portfolios by buying larger properties in less affluent areas, for instance three- or four-bedroom houses with parking and gardens.” Buy-to-let lending rose by 39% in 2015, the highest since 2007, and the third-highest year on record.

However, after the new guidelines set out by the Bank of England, landlords will face tougher borrowing standards in a bid to prevent the buy-to-let mortgage market from overheating.

The Prudential Regulation Authority (PRA) said lenders expected to grow their buy-to-let lending books over the next few years and that action was required to ensure underwriting standards did not slip. The PRA will require lenders to set a minimum borrower interest rate of 5.5% over a minimum period of five years when assessing affordability. The move is expected to reduce buy-to-let approvals by between 10-20% over the next two to three years.

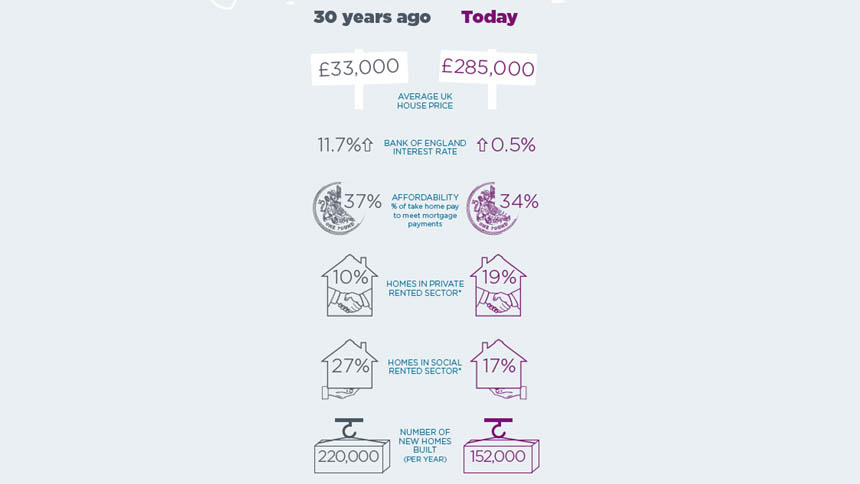

Over the past 30 years, average house prices in the UK have risen from £33,000 to £285,000, however the number of new homes being built per year has decreased, from 220,000, to 152,000.

(Sources for image: Office of National Statistics, Council of Mortgage Lenders, English Housing Survey, Department of Communities and Local Government)