Life insurance and critical illness cover – their importance to homebuyers

Posted 1 February 2017 by

Keith OsborneWhile most of us may not have the same moral problem with insurance as Homer Simpson’s neighbour Ned Flanders – “he considers it a form of gambling” says his wife – it may be true to say that many of us don’t see insurance as essential, or perhaps something we are often told to pay for that we may never see the benefit of.

Life insurance is perhaps the best-known form of income protection but while death and its consequences are something few of us think about very often, so too is serious illness, which can have equally serious consequences if it eliminates our ability to earn an income and settle our regular bills. For the latter, critical illness cover is an option to pay into, and while most of us may think the chances of such a thing happening to us are minimal, it’s probably more common than we think. For example, just one insurance company, Legal & General, paid out a total of £167m in critical illness claims to over 2,600 people for serious medical conditions that made them unable to work in 2015.

The Association of British Insurers reported that £3.6bn was paid out on income protection policies in 2015. It’s important to choose the right policy to go for, especially with such a huge market of options at your disposal, and to do that, it’s important to understand the benefits that you’re looking for, and those with a home of their own, or aiming to buy one, have yet another asset to consider in making their choice.

The Association of British Insurers reported that £3.6bn was paid out on income protection policies in 2015. It’s important to choose the right policy to go for, especially with such a huge market of options at your disposal, and to do that, it’s important to understand the benefits that you’re looking for, and those with a home of their own, or aiming to buy one, have yet another asset to consider in making their choice.

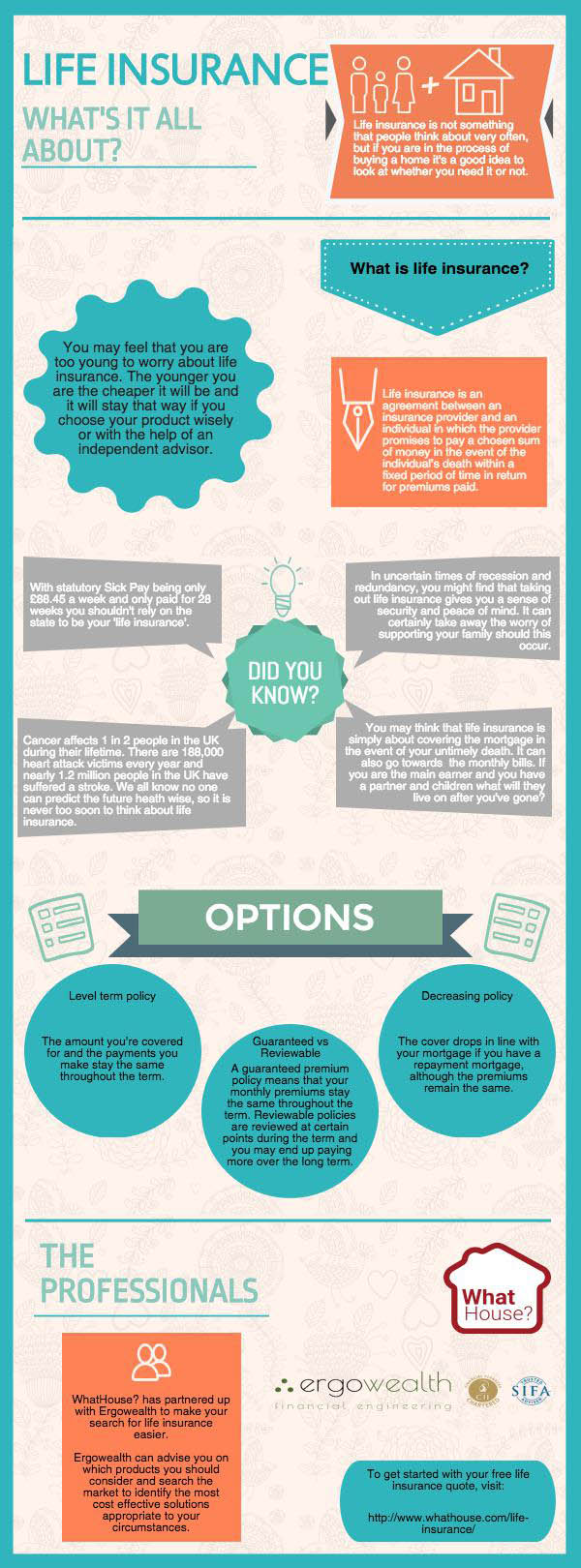

Here, to accompany our useful infographic, we take you through the essentials of life insurance and critical illness cover so that you are in a position to discuss what the best might be for you with a professional advisor.

What is life insurance?

Life insurance is a policy to cover an individual for a fixed period of time (for example, the length of time of a mortgage), paying out an agreed lump sum on that person’s death. It can be confused with the more expensive ‘life assurance’ or ‘whole-of-life’ insurance, which offers cover for a lifetime.

Why it is important for homebuyers?

Some sort of cover for your income is especially important if you own a home. With mortgage and utility bills to pay regularly, a lump sum on your death should cover these for your dependants, who may not have sufficient income, or a job at all, to afford the payments themselves.

Who needs it?

While you may think that you are too young to worry about your death, starting life cover at an early age usually means cheaper premiums and those premiums can stay relatively inexpensive as you get older, compared to someone starting a policy later in life.

It’s particularly important if your partner/offspring don’t have a paid job, or earn enough to comfortably cover monthly commitments. However, if you are single and without dependants, critical illness cover might be a better option.

How much does it cost?

This depends on the type of cover and the amount covered.

For a ‘level-term policy’, where payments stay the same across the time of cover, this might be around £10.00 per month on £250,000 over 25 years. For a ‘decreasing policy’, where the cover amount drops in line with your mortgage (such as with a repayment mortgage, where the capital debt is reduced over the duration of the home loan), the same cover might be around 20% cheaper.

You can also choose between ‘guaranteed premium’ policies, where the amount you pay remains fixed for the entire term, and ‘renewable’ policies, where the premiums are reviewed at certain points throughout the term and you could end up paying more over the complete period.

What is critical illness cover?

Critical illness cover is long-term insurance policy for an individual, covering specific serious medical conditions listed within a policy over a period of time. It is sometimes called critical illness insurance. The policy may cover a range of serious illnesses, such as strokes, heart attacks, multiple sclerosis and some cancers, though some illnesses may specifically be excluded, especially if they are health problems known before the cover is taken.

Where do you get life insurance from?

As with anything financial, your best way of finding the right option for you is to look for a professional source who can look at the products on the market and make an independent selection to meet your needs. You can take the first step with Whathouse.com on our life insurance/critical illness cover page.