A 2.5% interest rate rise could mean an annual average buy-to-let loss by 2020

Property crowdfunding platform Property Partner has undertaken research which shows that if interest rates were to rise just 2.5% by 2020, the average buy-to-let property would then be making an annual loss of £325.

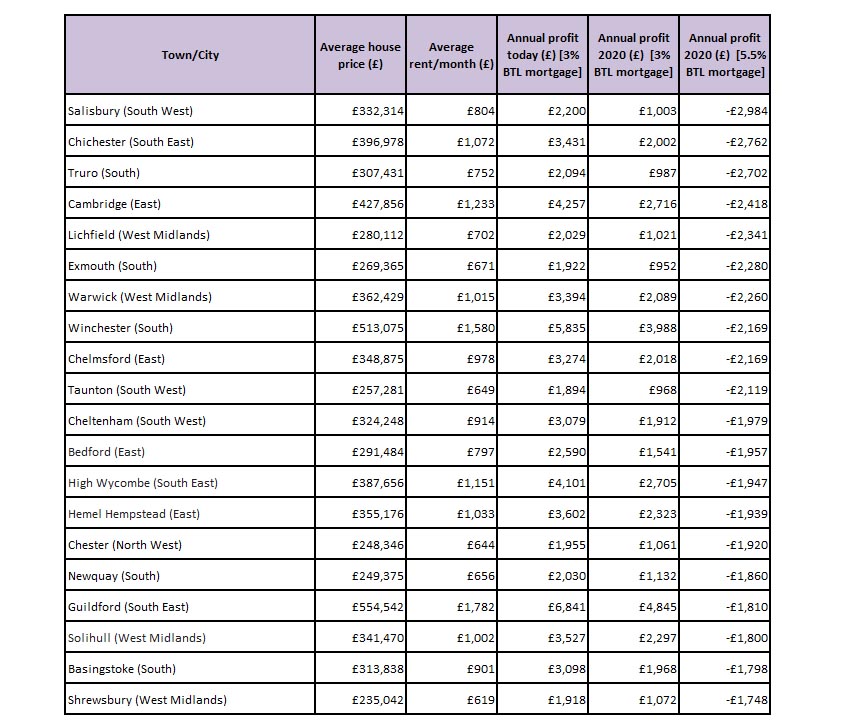

The findings are based on figures in 100 UK towns and cities, assuming a 60% loan-to-value mortgage fixed for three years at 3%, and follow George Osborne’s planned changes to mortgage interest relief currently benefitting property investors. They show that just 19% of places would still provide their investors with a net profit of more than £100 per month and that nearly 70% of towns would become unprofitable.

Many investors would have to rely on capital growth for a return on their property investment, rather than the monthly rental income.

On the survey’s assumptions, the average annual net profit would be £3,419 across the UK today, but would fall to £2,555 by 2020, even if rates remained at 3%, as a result of the phasing out of mortgage interest tax relief.

Salisbury in Wiltshire comes out worst in the research, with buy-to-let landlords currently making an average annual profit of £2,200 finding themselves at a loss of £2,984 per year. In Winchester and Cambridge – both strong markets right now – the drop from positive to negative is the greatest. In general, southern England seems to fair worst in the situation foreseen by the survey.

The towns ending up in the worst position in the Property Partner survey are:

Dan Gandesha, CEO of Property Partner, says: “The phased withdrawal of mortgage interest tax relief will be felt across the country, but add in a modest interest rate rise, and many investors will see their rental profits completely wiped out.

“When you factor in April’s stamp duty hike on new property purchases, it’s clear that direct investment in buy-to-let no longer adds up. Traditional landlords from Land’s End to John O’Groats need to face up to the stark reality. In a few years, the whole structure of the UK housing market will have changed.

“At Property Partner we’re seeing traditional landlords abandoning direct property investment and coming to us instead. It’s a tipping point. Landlords will lose out but millions more will be better off, with more affordable homes for first-time buyers, more high-quality accommodation for tenants, and an asset class made available for everyone to invest in.”